Knowledgeable support staff on-hand and online training materials.Used by some of the largest global brands like Nando’s, Nike, and Neovia, Vena provides a powerful suite of FP&A tools.

#Cashflow software software

This software has a number of solutions and tools to help facilitate better financial planning, cash flow management, financial reporting, and more. Vena is a cloud-based financial planning and cash flow software that enables financial teams to get a better handle on all of their financial data. View the pricing page for details about what's included in each package. The Cube pricing model is entirely transparent and upfront.

#Cashflow software full

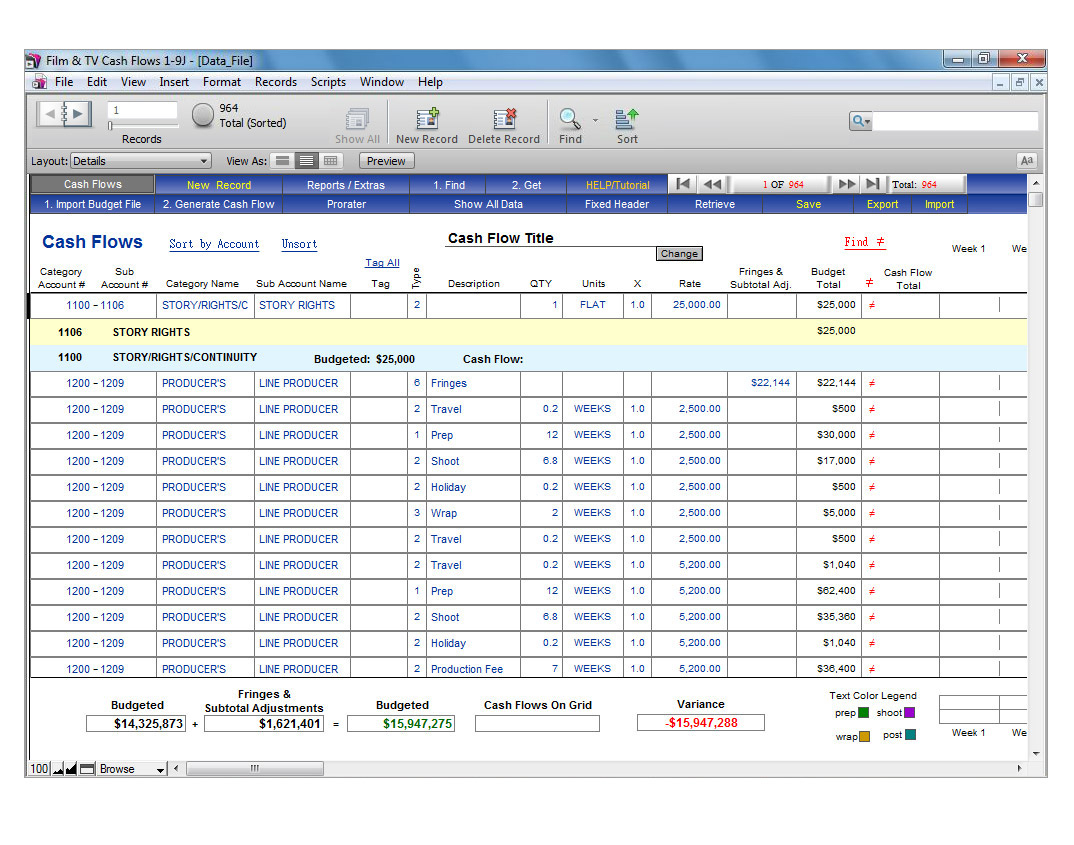

Drill down into individual transactions for a full audit history.Gain smarter, faster insights into your financial data in real-time.Intuitive spreadsheet integrations with Excel and Google Sheets.This platform is the only software that can automatically transfer data from any type of spreadsheet into a multi-dimensional database.Īll you need to do is connect all of your key data sources to Cube, then its intelligent mapping transforms your data into a single source of truth that you can analyze, share, and derive insights from. From preparing cash flows to scenario analysis and everything in between – Cube provides a robust solution in one place. CubeĬube is a next-generation FP&A platform that provides dynamic financial planning solutions. Here’s a closer look at some of the best cash flow management tools on the market: The 6 Best Cash Flow Management Software Tools 1. Integrating cash flow management software is an easy way to score quick wins on saving employee time by automating the processes involved in managing your cash flow.Ĭonvinced that you lack good cash flow management software in your organization? As you’ll see from the 6 tools below, these benefits just scraped the surface of what good software is capable of. Save Time and MoneyĪs a decision-maker within an organization, saving time and money are always two things high on your list of priorities. It also enables you to make decisions that can result in more revenue and better plan for the future. Knowing exactly how much cash is available can make or break for some businesses. The better your cash flow management is, the better financial decisions you’re able to make. By using cash flow software, you can be sure you always see an accurate and up-to-date view of how much cash is flowing into and out of your business.

The more accurate and up-to-date your cash flow data is, the better financial decisions you can make. If you’re still unsure if you should integrate cash flow software into your business, here are some compelling benefits of doing so: Access to Real-Time Data Why Should You Use Cash Flow Management Software?

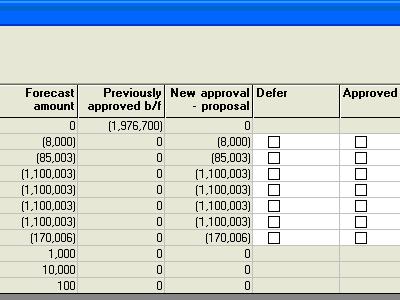

These solutions also give you the ability to forecast cash flow into the future across multiple what-if scenarios, so you can evaluate a variety of potential outcomes simultaneously. These solutions automatically connect Income Statement and Balance Sheet information from your accounting software and organize it into cash flow statements and reports, making it easy to uncover real-time insights into the nuances of your cash flow. In other words, it helps you regulate your business's financial health. Cash flow management software helps manage the past, present, and future cash flows in and out of your business.

0 kommentar(er)

0 kommentar(er)